Unravel why India’s net FDI plummeted 96.5% to $353M in 2025! Dive into fund repatriations, Indian firms going global, and global economic chaos shaking India’s economy. Get the 411 on FDI trends, investment opportunities, and economic growth for Millennials and Gen Z! 📉🌍

Introduction: What’s the Deal with India’s FDI? 🤔

Yo, Millennials and Gen Z, imagine a foreign company like Apple dropping a shiny new factory in Mumbai—boom, that’s Foreign Direct Investment (FDI)! 💥 It’s the cash flow that powers jobs, startups, and India’s dream of being a global economic superstar. But hold up—net FDI (money coming in minus money zooming out) has nosedived to a measly $353 million in 2025, down 96.5% from $10 billion last year (1). 😱 Why’s this happening? Grab your avocado toast or iced matcha, and let’s dive into this economic rollercoaster with a funky, easy-to-get vibe! 🎢

Why’s Net FDI Ghosting India? 👻

1. Fund Repatriations: Foreign Investors Cashing Out Like It’s a Party! 🎉

India’s stock market is poppin’ like a TikTok trend! Companies like Hyundai and Swiggy are hitting the IPO (Initial Public Offering) jackpot, letting foreign investors sell their shares and pocket mad profits. 💰 When these investors yeet their cash back home, it’s called fund repatriation, and it’s sucking net FDI dry. The Reserve Bank of India (RBI) says this hot IPO market is a major reason for the 96.5% FDI drop in FY25 (1). It’s like foreign investors are saying, “Thanks for the vibes, India, but we’re out!” ✌️

Table 1: India’s IPO Boom (2024-2025)

| Company | IPO Size (USD) | Foreign Investor Cash-Out (Est.) |

|---|---|---|

| Hyundai Motor | $3.3B | $1.5B |

| Swiggy | $1.4B | $0.8B |

Source: Estimated from market reports (1).

2. Indian Firms Going Global: Desi Companies Are World-Touring! 🌏

Indian businesses are flexing hard, investing in everything from Silicon Valley startups to factories in Vietnam. Big players like Tata and Reliance are like, “World, we’re coming for ya!” 😎 But here’s the tea: when Indian firms pour money into overseas investments, it counts as an FDI outflow, shrinking net FDI. The RBI points to this global hustle as a key culprit in FY25’s FDI crash (1). It’s dope for India’s rep, but it’s leaving our net FDI looking like a ghosted DM. 📩

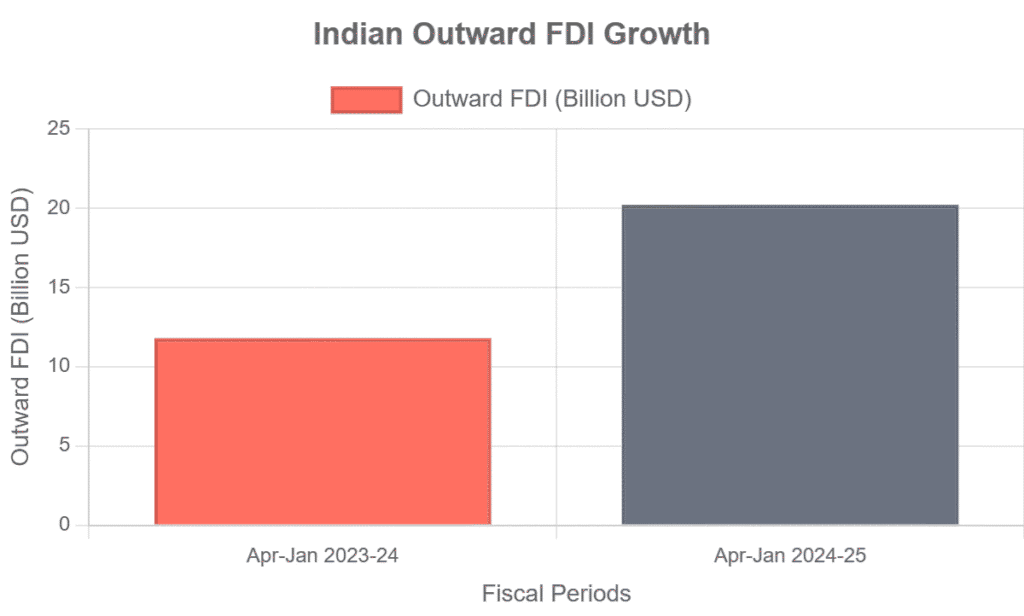

Figure 1: Indian Overseas Investments (2023-2025)

Source:(7)

3. Global Economic Drama: The World’s a Hot Mess! 🌪️

The global economy in 2025 is giving chaos vibes. Geopolitical tensions (think US-China trade shade) and sky-high borrowing costs are making investors clutch their wallets. The United Nations Conference on Trade and Development (UNCTAD) says global FDI dropped 2% to $1.3 trillion in 2023, and it’s still shaky (3). Add in supply chain hiccups and protectionist policies, and foreign investors are side-eyeing big bets on India (2). It’s like the world’s telling India, “Love ya, but we’re keeping our cash close.” 😬

Table 2: Global FDI Trends (2021-2023)

| Year | Global FDI (USD Trillion) | % Change |

|---|---|---|

| 2021 | 1.58 | +64% |

| 2022 | 1.33 | -16% |

| 2023 | 1.30 | -2% |

Source: UNCTAD World Investment Report 2024 (3).

Current FDI Trends in India: The Numbers Don’t Lie! 📈

Despite the net FDI drama, gross FDI inflows (money coming in) are holding steady-ish. From April to November 2024, gross FDI jumped 17.9% to $55.6 billion (4). But net FDI is tanking because of those massive outflows. Check this out:

Table 3: India’s FDI Inflows (in Billion USD)

| Fiscal Year | Gross FDI Inflows | Net FDI Inflows |

|---|---|---|

| FY23 | 71.4 | 42.0 |

| FY24 | 71.0 | 26.5 |

| FY25 (est.) | 55.6 (Apr-Nov) | 0.353 |

Source: RBI and Business Standard (1, 4).

This table screams that while India’s economy is still a hot destination, the money’s slipping out faster than you can say “#EconomicGrowth”! 😅

Conclusion: What’s Next for India’s FDI? 🚀

Alright, Millennials and Gen Z, here’s the deal: India’s net FDI is in a 2025 slump, thanks to fund repatriations, Indian firms’ global glow-up, and a messy global economy. But don’t panic—gross FDI is still flowing, and India’s on track to be the world’s fourth-largest economy by 2025 (6). To keep the economic growth party going, India needs to drop some 🔥 policies—like tax breaks or reinvestment perks—to keep foreign cash in the game. For y’all, this matters because FDI funds the startups, tech hubs, and gig economy jobs you’re vibing with. So, stay woke on India’s economy, and let’s cheer for a comeback! 💪✨

References

- The Wire. India’s net foreign direct investment plummets by 96.5% to reach record low [Internet]. 2025 [cited 2025 Jun 3]. Available from: https://m.thewire.in/article/economy/indias-net-foreign-direct-investment-plummets-by-96-5-to-reach-record-low

- Livemint. Economic Survey 2024: India’s FDI inflow weakens due to geopolitical conflicts [Internet]. 2024 Jul 22 [cited 2025 Jun 3]. Available from: https://www.livemint.com/economy/economic-survey-2024-indias-fdi-inflows-slows-down-11721632363987.html

- United Nations Conference on Trade and Development. World Investment Report 2024 [Internet]. 2024 [cited 2025 Jun 3]. Available from: https://unctad.org/publication/world-investment-report-2024

- Business Standard. India’s FDI inflows rise 17.9% in FY25, Economic Survey [Internet]. 2025 Jan 31 [cited 2025 Jun 3]. Available from: https://www.business-standard.com/budget/news/india-fdi-inflows-economic-survey-investment-growth-challenges-125013101448_1.html

- Vision IAS. Foreign Direct Investment (FDI) [Internet]. 2025 Jan 22 [cited 2025 Jun 3]. Available from: https://visionias.in/current-affairs/monthly-magazine/2025-01-22/economics-%28macroeconomics%29/foreign-direct-investment-fdi-2

- India Briefing. India Economy 2024: GDP growth and FDI performance [Internet]. 2024 Dec 20 [cited 2025 Jun 3]. Available from: https://www.india-briefing.com/news/india-economy-2024-gdp-growth-rate-fdi-trade-performance-35614.html/

- Business Standard. Net FDI dips to $1.4 bn in Apr-Jan 2025; gross FDI rises 12.4%: RBI data [Internet]. 2025 Mar 19 [cited 2025 Jun 3]. Available from: https://www.business-standard.com/finance/news/net-fdi-dips-to-1-4-bn-in-apr-jan-2025-gross-fdi-rises-12-4-rbi-data-125031901120_1.html