Discover the top 5 payment apps in the USA for 2025, perfect for millennials and Gen Z! From P2P transfers to contactless payments, these mobile payment apps offer secure transactions, social features, and crypto trading. Get the scoop on PayPal, Apple Pay, Venmo, Cash App, and Zelle with 90M+ users driving digital payments in 2025! 🚀

The Mobile Payment Party: Why Millennials & Gen Z Are Obsessed! 🎉

Hey, millennials (you 80s and 90s babies) and Gen Z (the TikTok trendsetters), let’s talk money moves! In 2025, payment apps are your BFFs for everything—splitting pizza bills 🍕, snagging online deals 🛍️, or even dabbling in Bitcoin 💰. These apps aren’t just about paying; they’re about vibing with your digital wallet and flexing those secure transactions. According to a 2024 YouGov survey, 25% of 18-24-year-olds and 23% of 25-34-year-olds are all-in on mobile payment apps for in-store buys, while only 8% of boomers are catching up (1). That’s right, you’re leading the digital payment revolution! 🚀

Why the hype? These cash apps are fast, fun, and packed with social features that make sending money feel like posting a fire Instagram story. Plus, they’ve got encryption for safety and cool perks like crypto trading or bill splitting. Ready to dive into the top 5 payment apps that’ll keep your wallet and your vibes on point? Let’s go! 😎

The Fab Five: Top Payment Apps for 2025 🏆

1. PayPal: The OG of Digital Payments 👑

What’s the Deal? Born in 1998, PayPal is the granddaddy of payment apps, with 91.5 million US users projected for 2025 (2,3). From online shopping to P2P transfers, this app does it ALL—think buy now pay later (BNPL), crypto trading, and even paying your fave Etsy seller. 🌍

Why It’s Lit for Millennials & Gen Z: PayPal is like that reliable friend who’s always got your back. Its encryption keeps your money safe, and Pay in 4 lets you snag those sneakers without breaking the bank—37% of Gen Z loves BNPL (2). Wanna buy Bitcoin or send cash to your bestie? PayPal’s got you covered with a slick interface that’s easy AF. 😍

Cool Stuff:

- Online payments with One Touch.

- P2P transfers for quick cash sends.

- Crypto trading (hello, Bitcoin!).

- BNPL for stress-free shopping.

2. Apple Pay: The Contactless Payment King for iPhone Stans 🍎

What’s the Deal? Since 2014, Apple Pay has been slaying with 60.2 million US users in 2024 and counting (4). It’s the go-to for iPhone users, offering contactless payments, online purchases, and P2P transfers via Apple Cash. 🤑

Why It’s Lit for Millennials & Gen Z: If you’re glued to your iPhone, Apple Pay is your jam. Tap your phone at Starbucks, and BOOM—coffee paid! 😜 Its Face ID and Touch ID make secure transactions a breeze, and 43% of users say security is their top vibe (1). Gen Z loves it for in-store buys, with 58% tapping away in 2024 (4). Plus, Apple Cash lets you send money faster than you can say “Siri, pay my friend!”.

Cool Stuff:

- Contactless payments with NFC magic.

- Secure transactions with tokenization.

- Apple Cash for P2P transfers.

- Loyalty cards and tickets in one spot.

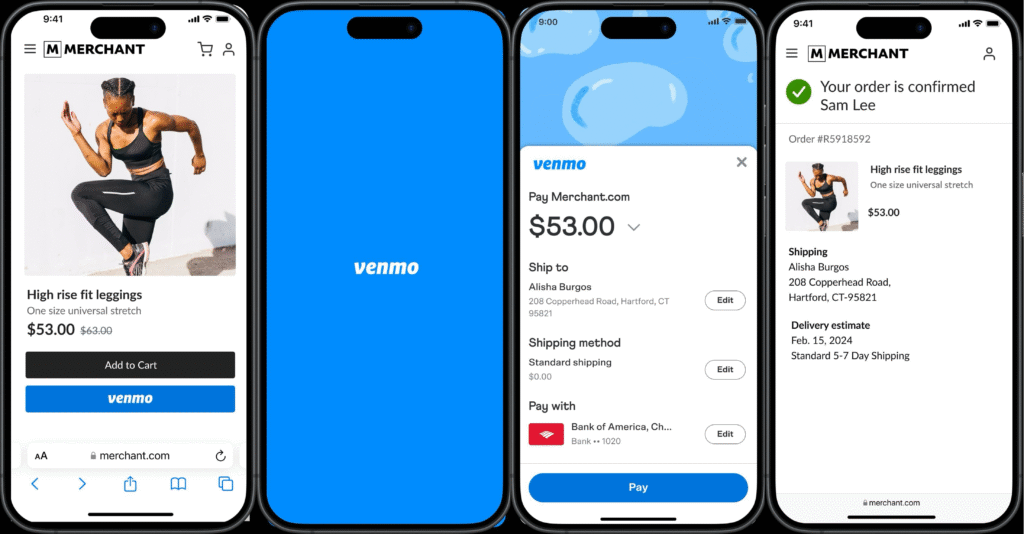

3. Venmo: The Social Payment App That’s a Whole Mood 😎

What’s the Deal? Launched in 2009 and snatched by PayPal in 2013, Venmo has 90 million US users vibing in 2024 (2). Its social feed lets you flex your P2P transfers with emojis and notes like “Pizza Night 🍕”. 🫶

Why It’s Lit for Millennials & Gen Z: Venmo is the ultimate social payment app. Splitting rent? Paying for tacos? Venmo makes it fun with its feed—50% of 18-29-year-olds and 49% of 30-49-year-olds are hooked (5). It’s like Snapchat but for money! 😅 No fees for P2P transfers, and you can even pay some merchants. Gen Z and millennials, this is your squad’s go-to for group hangs.

Cool Stuff:

- P2P transfers with a social feed.

- Bill splitting for group dates.

- “Pay with Venmo” at select stores.

- Optional debit card for direct spending.

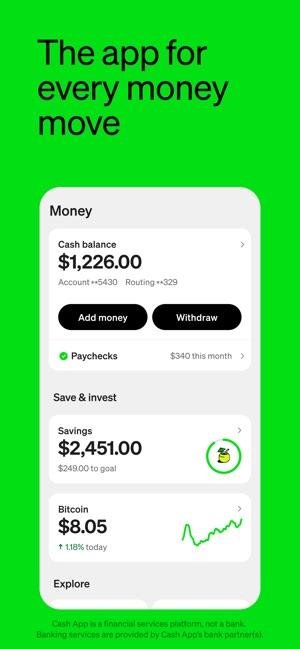

4. Cash App: Your Digital Wallet for Money and More 💸

What’s the Deal? Created by Block in 2013, Cash App has 57 million monthly active users in 2024 (6). It’s not just P2P transfers—you get a Cash Card, direct deposits, and investing in stocks or Bitcoin. 🚀

Why It’s Lit for Millennials & Gen Z: Cash App is for the hustlers! With 53.71% of users aged 18-34, it’s a fave for Gen Z and millennials who wanna grow their cash (7). Buy a stock or Bitcoin with a tap, or use the Cash Card to flex at the mall. Its simple design screams “I got this!” and makes digital payments feel like a game. 🎮

Cool Stuff:

- P2P transfers with zero fees (standard).

- Investing in stocks and Bitcoin.

- Cash Card for direct purchases.

- Direct deposit for your paycheck.

5. Zelle: The Speedy Bank Transfer Boss 🏦

What’s the Deal? Born in 2017, Zelle is a P2P payment service with 151 million enrolled accounts in 2024, moving $1 trillion that year (8). It’s baked into your bank’s app for lightning-fast bank transfers. ⚡

Why It’s Lit for Millennials & Gen Z: Zelle is like the quiet kid who gets stuff done. No social feed, but it’s FAST and linked to your bank, so 17% of US adults use it (1). It’s perfect for secure transactions when you need to send rent money ASAP. Millennials and Gen Z love the no-fuss vibe, even if it’s not as flashy as Venmo. 😴

Cool Stuff:

- Instant P2P transfers between banks.

- Built into major banking apps.

- No fees for standard transfers.

- Handles BIG money ($1T in 2024!).

Let’s Break It Down: Which Payment App Is Your Vibe? 🤔

Check out this dope comparison of the top 5 payment apps to find your match:

| App Name | User Base (US, 2024) | Key Features | Vibe Check |

|---|---|---|---|

| PayPal | 91.5M (2025 est.) | Online payments, P2P, BNPL, crypto | The all-in-one for millennials & Gen Z |

| Apple Pay | 60.2M | Contactless payments, Apple Cash | iPhone lovers’ dream |

| Venmo | 90M | Social feed, bill splitting | Gen Z & millennials who live for the group chat |

| Cash App | 57M | Investing, Cash Card | Hustlers chasing Bitcoin & stocks |

| Zelle | 151M accounts | Bank transfers, no fees | Low-key secure transactions |

Spill the Tea:

- PayPal is your global BFF, perfect for online shopping and crypto trading. Gen Z loves Pay in 4 for budget vibes (2).

- Apple Pay is the iPhone squad’s pick, with 58% using it in stores (4). Secure transactions? Check! ✅

- Venmo is the life of the party, with 83% of 18-34-year-olds on board (9). Split that bill and flex it! 😎

- Cash App is for the money makers, with 39% of 18-29-year-olds investing (10). Bitcoin, anyone? 💸

- Zelle keeps it chill with $1T in transfers, but it’s less fun for social payments (8).

Pro Tip: Millennials and Gen Z, pick based on your vibe! Love social features? Go Venmo. Wanna invest? Cash App. iPhone stan? Apple Pay. Need it all? PayPal. Just want fast bank transfers? Zelle. 😏

Wrapping It Up: Your Payment App Game Plan for 2025 🎯

In 2025, payment apps are the ultimate flex for millennials and Gen Z. Whether you’re splitting brunch bills 🍳, buying Bitcoin 📈, or tapping your iPhone for contactless payments, these apps are your digital wallet superheroes. PayPal brings the world to your fingertips, Apple Pay keeps it sleek, Venmo makes money social, Cash App fuels your hustle, and Zelle gets it done fast. 🚀

What’s next? Expect AI-driven fraud protection and maybe even social media tie-ins to make these apps even cooler. So, grab your phone, download your fave cash app, and start slaying those digital payments like the boss you are! 💪

References

- YouGov. Understanding the use of mobile payment apps among American consumers [Internet]. 2024 [cited 2025 Jun 4]. Available from: https://business.yougov.com/content/51052-understanding-the-use-of-mobile-payment-apps-among-american-consumers

- Chargeflow. PayPal statistics, facts & figures for 2025 [Internet]. 2024 [cited 2025 Jun 4]. Available from: https://www.chargeflow.io/blog/paypal-statistics-facts

- eMarketer. PayPal dominates mobile payments in the US [Internet]. 2024 [cited 2025 Jun 4]. Available from: https://www.emarketer.com/content/paypal-dominates-mobile-payments-us

- Oberlo. How many people use Apple Pay in the US? [Internet]. 2024 [cited 2025 Jun 4]. Available from: https://www.oberlo.com/statistics/how-many-people-use-apple-pay

- Oberlo. How many people use Venmo? [Internet]. 2024 [cited 2025 Jun 4]. Available from: https://www.oberlo.com/statistics/how-many-people-use-venmo

- Business of Apps. Cash App revenue and usage statistics (2025) [Internet]. 2024 [cited 2025 Jun 4]. Available from: https://www.businessofapps.com/data/cash-app-statistics/

- SignHouse. Cash App stats [Internet]. 2024 [cited 2025 Jun 4]. Available from: https://usesignhouse.com/blog/cash-app-stats/

- Zelle. More people than ever choose Zelle: Nearly half a trillion dollars sent in first half of 2024 [Internet]. 2024 [cited 2025 Jun 4]. Available from: https://www.zellepay.com/press-releases/more-people-ever-choose-zelle-nearly-half-trillion-dollars-sent-first-half-2024

- BuyBitcoinWorldwide. 51 Venmo revenue & users statistics (2024) [Internet]. 2024 [cited 2025 Jun 4]. Available from: https://buybitcoinworldwide.com/venmo-statistics/

- Oberlo. How many people use Cash App? [Internet]. 2024 [cited 2025 Jun 4]. Available from: https://www.oberlo.com/statistics/how-many-people-use-cash-app