Yo, millennials and Gen Z! Ready to level up your finance game in 2025? 🚀 Dive into the fintech revolution with apps like SoFi and Chime, where 80% of you are already vibing with digital banking (1). Obsessed with ESG investing? 25% of you own sustainable stocks (3). But watch out—only 24% of millennials get the stock market basics, and 64% of Gen Z have been duped by shady finfluencers (3,4). Get the tea on AI, blockchain, and wealth management to secure your bag! 💰 #FinanceTrends #MoneyMindset

Fintech Frenzy: Banking That’s Bussin’! 😎📱

Listen up, fam! Millennials and Gen Z are straight-up running the fintech show, and it’s giving main character energy! 💪 Why? ‘Cause you’re all about that digital-first life—think apps that make banking smoother than your fave TikTok transition (1). Fintech platforms like Ramp, Brex, SoFi, Chime, and Nubank are serving looks and functionality (2). Here’s the vibe:

- Ramp: Corporate cards and expense trackers that make your biz life a breeze. Say bye to receipts piling up! 🧾

- SoFi: From student loan refinancing to investing, it’s your one-stop shop for adulting like a pro. 🤑

- Chime: Fee-free banking and digital wallets that scream “I’m broke but make it chic!” 💸

Real talk: 80% of you are already sliding into money transfer apps, and 53% of Gen Z want online customer support (2). Plus, with only 24% of millennials knowing their way around the stock market, these apps are dropping gamified learning and expert tips to make you a finance guru (4). By 2025, AI and blockchain are gonna make these platforms even spicier, with personalized advice and super-secure transactions (4). Who’s ready to flex their financial freedom? 🙌

Table 1: Fintech Apps Millennials & Gen Z Are Obsessed With

| App | What’s Poppin’ | Why You’ll Stan It |

|---|---|---|

| Ramp | Corporate cards, auto-expenses | Perfect for your side hustle |

| SoFi | Loans, investing, banking | Millennial must-have |

| Chime | No fees, digital wallets | Gen Z’s budget BFF |

| Brex | Biz accounts, high-limit cards | Startup slay vibes |

| Nubank | Digital-first banking | Techy and trendy |

Source: Q2 Report (2).

Investing Like a Boss: ESG & Crypto Are the Mood! 📈🌍

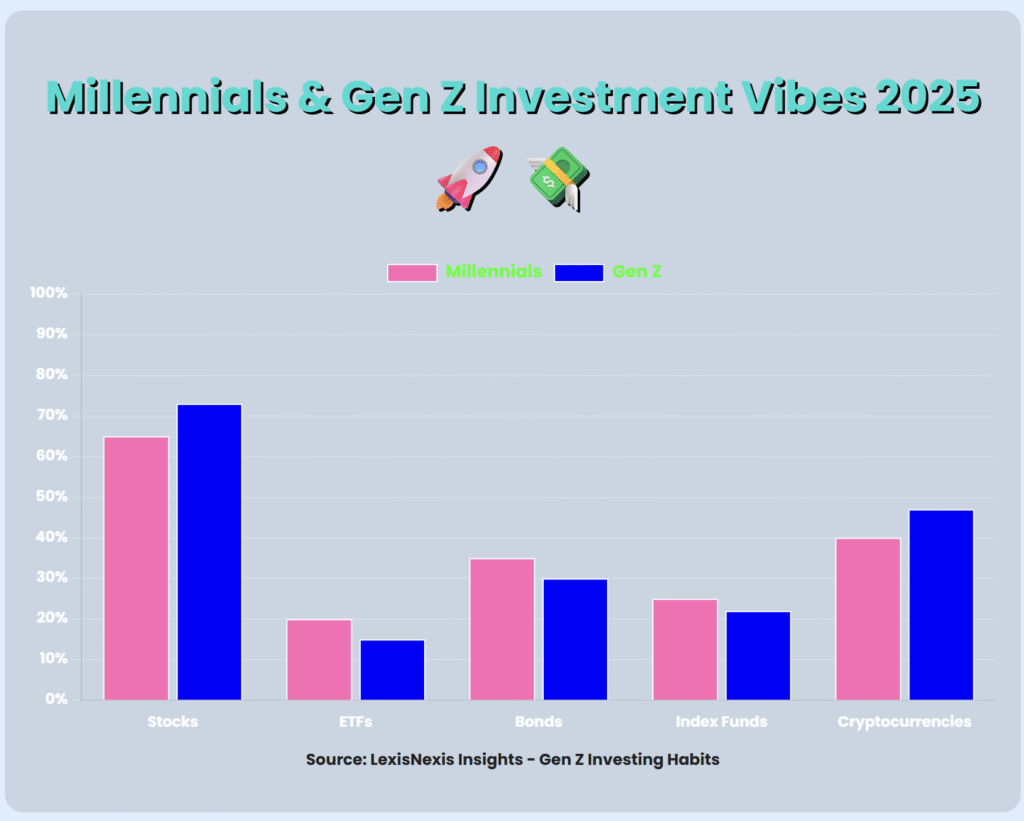

Millennials and Gen Z, you’re not just investing—you’re making statements! 💅 Your investment game is diverse AF, and you’re all about sustainable investing (3). Check the stats:

- Stocks: 73% of Gen Z and 65% of millennials are buying into brands like Starbucks and Nike. Iconic! ☕👟

- ETFs: 15% of Gen Z, 20% of millennials—diversification is your love language.

- Bonds: 30% of Gen Z, 35% of millennials—keeping it stable, not stale.

- Index Funds: 22% of Gen Z, 25% of millennials—low risk, high slay.

- Cryptocurrencies: 47% of Gen Z, 40% of millennials—HODLing like it’s 2021! 🚀

The real glow-up? ESG investing! A solid 25% of you are pouring cash into sustainable stocks that vibe with your save-the-planet energy, and 90% of Gen Z say companies better care about the environment or they’re canceled (3). But hold up—finfluencers on TikTok and Insta are serving hot tips and hot messes. A wild 64% of Gen Z have been scammed by “get rich quick” schemes (3). Moral of the story? Double-check those investment tips before you YOLO your savings! 😬

Table 2: How Millennials & Gen Z Are Investing

| Investment Type | Millennials (%) | Gen Z (%) |

|---|---|---|

| Stocks | 65 | 73 |

| ETFs | 20 | 15 |

| Bonds | 35 | 30 |

| Index Funds | 25 | 22 |

| Cryptocurrencies | 40 | 47 |

Source: LexisNexis Insights (3).

Levelling Up with Financial Smarts & Tech! 🧠💻

Okay, let’s get real: Financial literacy is low-key a struggle, with only 24% of millennials knowing what’s good in the stock market (4). And 48% of Gen Z and 46% of millennials are stressing about financial security—yikes! 😅 But don’t sleep on the comeback! Fintech companies are teaming up with schools to make financial education as bingeable as your fave Netflix show (4). Think interactive apps, quizzes, and videos that make budgeting and investing feel like a game (1).

And the tech? It’s giving futuristic! By 2025, AI will be your personal money coach, dropping customized tips like “Yo, maybe skip that $7 latte” (4). Meanwhile, blockchain is keeping your transactions safer than your group chat secrets 🤫. But heads-up: navigating new regulations and trusting digital platforms can be tricky, especially when Gen Z sometimes vibes with random X posts over legit advisors (3). Stay woke, fam—your wealth management game deserves the best! 💪

Table 3: Financial Struggles Millennials & Gen Z Face

| Struggle | Millennials (%) | Gen Z (%) |

|---|---|---|

| Not Feeling Financially Secure | 46 | 48 |

| Stock Market Know-How | 24 | N/A |

Source: Deloitte Survey (1), ET Edge Insights (4).

Conclusion

Millennials and Gen Z, you’re the MVPs of the 2025 finance scene! 🏆 You’re flipping the script with fintech apps like SoFi and Chime, making banking and investing as easy as posting a fire selfie (2). Your love for ESG investing and sustainable finance is pushing companies to do better, and 25% of you are already backing green stocks (3). But with only 24% of millennials getting the stock market and 64% of Gen Z falling for finfluencer scams, it’s time to level up your financial literacy (3,4). Lean into AI and blockchain for next-level wealth management, and keep those money moves smart! Here’s to slaying the finance game in 2025! 🎉 #MoneyMindset #SecureTheBag

References

- Deloitte. 2025 Global Gen Z and Millennial Survey [Internet]. 2025 [cited 2025 Jun 5]. Available from: https://www.deloitte.com/global/en/issues/work/genz-millennial-survey.html

- Q2. Gen Z and Millennial Perspectives on Emerging Trends in Banking and Finance [Internet]. 2025 [cited 2025 Jun 5]. Available from: https://www.q2.com/company/news/pr/gen-z-and-millennial-perspectives-on-emerging-trends-in-banking-and-finance

- LexisNexis. Gen Z Investing Habits [Internet]. 2025 [cited 2025 Jun 5]. Available from: https://www.lexisnexis.com/community/insights/professional/b/industry-insights/posts/gen-z-investing-habits

- ET Edge Insights. How Millennials and Gen Z Are Redefining the Future of Investing [Internet]. 2025 [cited 2025 Jun 5]. Available from: https://etedge-insights.com/markets/how-millennials-and-gen-z-redefining-the-future-of-investing/

- Deloitte. Trends in Millennials’ Banking InFocus [Internet]. 2025 [cited 2025 Jun 5]. Available from: https://www2.deloitte.com/us/en/pages/consulting/articles/trends-in-millennial-banking-infocus.html