Explore how artificial intelligence in finance is transforming investment strategies, fraud detection, and customer service in 2025. Discover key trends, ethical challenges, and future opportunities for millennials and Gen Z in this AI-driven financial revolution. Stay ahead with insights on robo-advisors, financial technology, and more.

Introduction to AI in Finance

Artificial intelligence (AI) is reshaping the finance industry by leveraging cutting-edge technologies like machine learning, natural language processing, and predictive analytics. These tools empower financial institutions to analyze massive datasets, automate complex tasks, and deliver personalized financial services. For millennials and Gen Z, who prioritize convenience and digital solutions, AI in finance offers exciting ways to manage money, invest smarter, and stay secure.

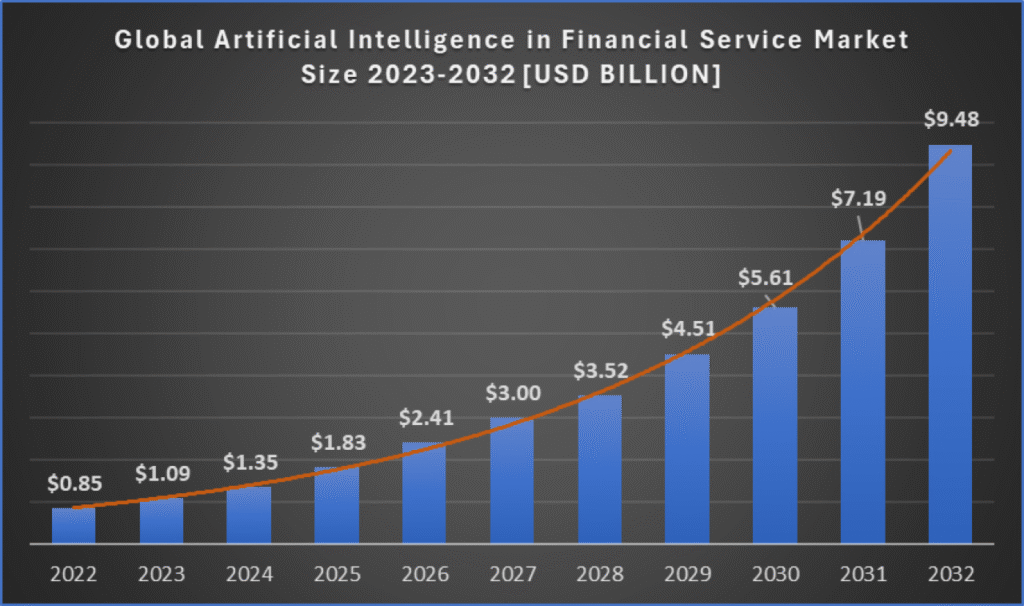

The adoption of AI in finance is skyrocketing. By 2025, 85% of financial institutions are expected to implement AI technologies, up from 45% in 2022 [1]. This surge reflects AI’s ability to enhance financial efficiency, reduce costs, and improve decision-making. Whether you’re budgeting for travel or diving into stock trading, AI-driven financial tools are making money management more accessible and engaging.

In this blog, we’ll dive into three key areas of AI in finance: investment and trading, risk management and fraud detection, and customer service personalization. We’ll also explore future trends and ethical considerations, ensuring millennials and Gen Z can navigate this financial revolution with confidence.

Key Applications of AI in Finance

Investment and Trading: Empowering Wealth Creation

AI in finance has revolutionized investment strategies and stock trading through advanced algorithms that process market data at lightning speed. High-frequency trading (HFT) firms use machine learning to execute thousands of trades per second, capitalizing on tiny price movements [2]. These systems analyze historical data, corporate earnings, and even social media sentiment to predict market trends, giving investors a competitive edge.

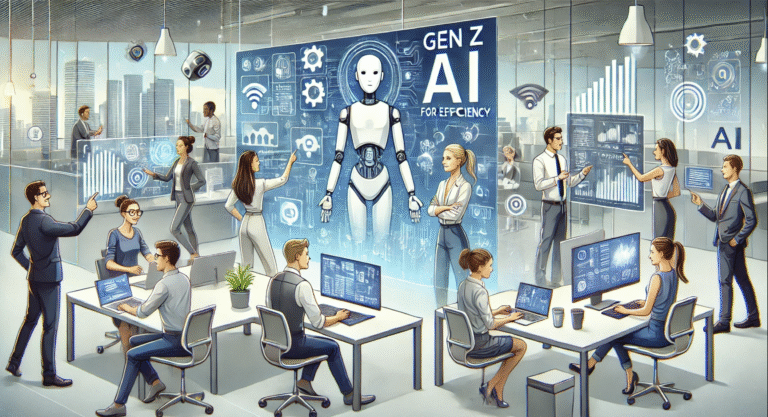

For millennials and Gen Z, robo-advisors like Betterment and Wealthfront are game-changers. These AI-powered platforms create personalized investment portfolios based on your risk tolerance and goals, offering low-cost alternatives to traditional advisors. A 2023 survey found that 31% of Gen Z and 20% of millennials use robo-advisors, highlighting their appeal to younger investors [3]. With financial technology making investing accessible, AI in finance is empowering wealth creation for all.

Table 1: Traditional Advisors vs. Robo-Advisors in 2025

| Feature | Traditional Advisors | Robo-Advisors |

|---|---|---|

| Cost | High fees | Low or no fees |

| Accessibility | Limited hours | 24/7 online investing |

| Personalization | Advisor judgment | AI-driven analytics |

| Minimum Investment | Often high | Low or none |

Risk Management and Fraud Detection: Securing Your Money

AI in finance is transforming risk management and fraud detection by analyzing patterns and anomalies in real-time. In risk management, AI models predict potential risks by examining historical data, enabling proactive strategies to minimize losses. For fraud detection, AI systems monitor transactions instantly, identifying suspicious activities with high accuracy. For example, JPMorgan Chase uses AI to reduce false positives in fraud detection, enhancing user experience [4].

In 2025, 91% of U.S. banks leverage AI for fraud detection, showcasing its effectiveness in combating financial crime [1]. Techniques like supervised learning train models on known fraud patterns, while unsupervised learning detects new threats by identifying outliers. For millennials and Gen Z, this means safer digital banking and mobile payments, ensuring peace of mind in a cashless economy.

Customer Service and Personalization: Tailored Financial Services

AI in finance is redefining customer service through chatbots and virtual assistants that offer 24/7 support. These tools handle routine tasks like checking balances or resolving fraud claims, while also providing personalized financial advice based on user data. For instance, AI chatbots guide users through account setup or loan applications, reducing wait times [5].

A 2024 report predicts that 81% of customer experience leaders believe AI will boost satisfaction by delivering intuitive, always-on service [5]. For millennials and Gen Z, who crave instant access and tailored experiences, AI-driven personalization makes financial services more engaging and relevant.

The Future of AI in Finance: Opportunities and Challenges

The future of AI in finance is brimming with potential, driven by innovations like generative AI. This technology can create synthetic data, generate financial reports, and simulate market scenarios for stress testing. The generative AI market in financial services is expected to grow from $2.7 billion in 2024 to $18.9 billion by 2030, with a CAGR of 38.7% [6].

However, AI in finance also raises ethical challenges that demand attention:

- Bias and Fairness: AI algorithms can inherit biases from historical data, potentially leading to unfair lending decisions or investment strategies. Regular audits and diverse datasets are crucial [7].

- Data Privacy: AI’s reliance on vast datasets raises concerns about user privacy. Strong encryption and data protection policies are essential.

- Transparency: Complex AI models can be opaque, making decisions hard to understand. Explainable AI is needed to build trust.

- Regulatory Compliance: Financial institutions must navigate evolving AI regulations to ensure compliance and address algorithmic transparency.

While AI may automate routine tasks, it’s also creating new roles, with 8-9% of global jobs by 2030 expected to be in emerging fields like data science [1]. Millennials and Gen Z can stay competitive by upskilling in AI and financial analytics.

Conclusion

AI in finance is revolutionizing money management, offering millennials and Gen Z unparalleled opportunities for investment, security, and personalized services. From robo-advisors to fraud detection systems, AI-driven financial tools are making finance more accessible and engaging. However, ethical challenges like bias, privacy, and transparency must be addressed to ensure a fair financial future.

As we head into 2025, staying informed about AI in finance will empower you to make smarter financial decisions. Whether you’re saving for a dream vacation or exploring stock trading, AI is your ally in navigating the digital finance landscape. Embrace the financial revolution, but stay vigilant about its ethical implications.

References

[1] All About AI, “AI in Finance Statistics 2025: Impact, Trends & Insights,” 2025. [Online]. Available: https://www.allaboutai.com/resources/ai-statistics/finance/

[2] Forbes Technology Council, “AI in Financial Services: Transforming Stock Trading,” Forbes, Mar. 2024. [Online]. Available: https://www.forbes.com/councils/forbestechcouncil/2024/03/01/ai-in-financial-services-transforming-stock-trading/

[3] The Conversation, “Robo-Advisers: Pros and Cons of Using AI in Investing,” 2024. [Online]. Available: https://theconversation.com/robo-advisers-are-here-the-pros-and-cons-of-using-ai-in-investing-224044

[4] Accredian, “How AI is Revolutionizing Risk Management and Fraud Detection in Finance,” 2024. [Online]. Available: https://blog.accredian.com/how-ai-is-revolutionizing-risk-management-and-fraud-detection-in-finance/

[5] Zendesk, “AI in Finance: Top Use Cases and Benefits to Know,” 2024. [Online]. Available: https://www.zendesk.com/blog/ai-in-finance/

[6] GlobeNewswire, “Generative Artificial Intelligence in Financial Services Strategic Business Report 2025,” Mar. 2025. [Online]. Available: https://www.globenewswire.com/news-release/2025/03/19/3045626/28124/en/Generative-Artificial-Intelligence-in-Financial-Services-Strategic-Business-Report-2025-Global-Market-to-Grow-by-16-2-Billion-During-2024-2030-Expansion-of-AI-Chatbots-Creates-New-.html

[7] Redress Compliance, “Ethical Considerations of AI in Finance,” 2024. [Online]. Available: https://redresscompliance.com/ethical-considerations-of-ai-in-finance/