Unlock the full potential of your £20,000 ISA allowance in 2025 with this ultimate guide for millennials and Gen Z. Learn expert tips to boost tax-free savings, invest for long-term wealth, and save for your first home using Lifetime ISAs, Cash ISAs, and Stocks and Shares ISAs. Start building your financial future today! (150 characters)

Introduction

Individual Savings Accounts (ISAs) are your ticket to tax-free savings and investing in the UK, with a generous £20,000 ISA allowance for the 2025/26 tax year [1]. Whether you’re dreaming of owning your first home, growing your wealth, or keeping your savings safe, ISAs offer flexibility and tax perks that millennials and Gen Z can’t ignore. This guide breaks down three killer strategies to make your money work harder, packed with relatable examples and pro tips to supercharge your personal finance game.

Save Smarter for Your First Home with a Lifetime ISA

Buying your first home feels like chasing a unicorn, but a Lifetime ISA (LISA) makes it real. If you’re 18–39, you can save up to £4,000 a year, and the government throws in a 25% bonus—up to £1,000 free cash annually [2]. That’s a serious boost for your deposit in the crazy UK housing market.

Picture Zara, a 26-year-old graphic designer in Manchester. She’s got her eyes on a £200,000 flat in a few years. By maxing out her LISA at £4,000 each year, Zara scores a £1,000 bonus annually. After five years, she’s got £25,000 (£20,000 saved + £5,000 bonus) toward her dream home. Not bad, right?

Key LISA Rules

- Property must cost under £450,000 and be in the UK.

- LISA must be open for 12 months before use.

- Non-home withdrawals before age 60 trigger a 25% penalty, which could eat into your savings [2].

- The £4,000 LISA counts toward your £20,000 ISA allowance, leaving room for other ISAs [3].

Pro Tip: Short-term buyers should pick a Cash LISA for safety, while those with 5+ years can try a Stocks and Shares LISA for growth. Compare providers on sites like Moneyfacts to snag the best rates [3].

LISA Savings Growth Table

| Year | Annual Contribution | Annual Bonus | Cumulative Total |

|---|---|---|---|

| 1 | £4,000 | £1,000 | £5,000 |

| 2 | £4,000 | £1,000 | £10,000 |

| 3 | £4,000 | £1,000 | £15,000 |

| 4 | £4,000 | £1,000 | £20,000 |

| 5 | £4,000 | £1,000 | £25,000 |

Grow Your Wealth with a Stocks and Shares ISA

Want to build long-term wealth without the taxman taking a bite? A Stocks and Shares ISA lets you invest in stocks, bonds, or funds, with all gains and dividends tax-free [4]. It’s perfect for millennials and Gen Z, who’ve got decades to let their money grow.

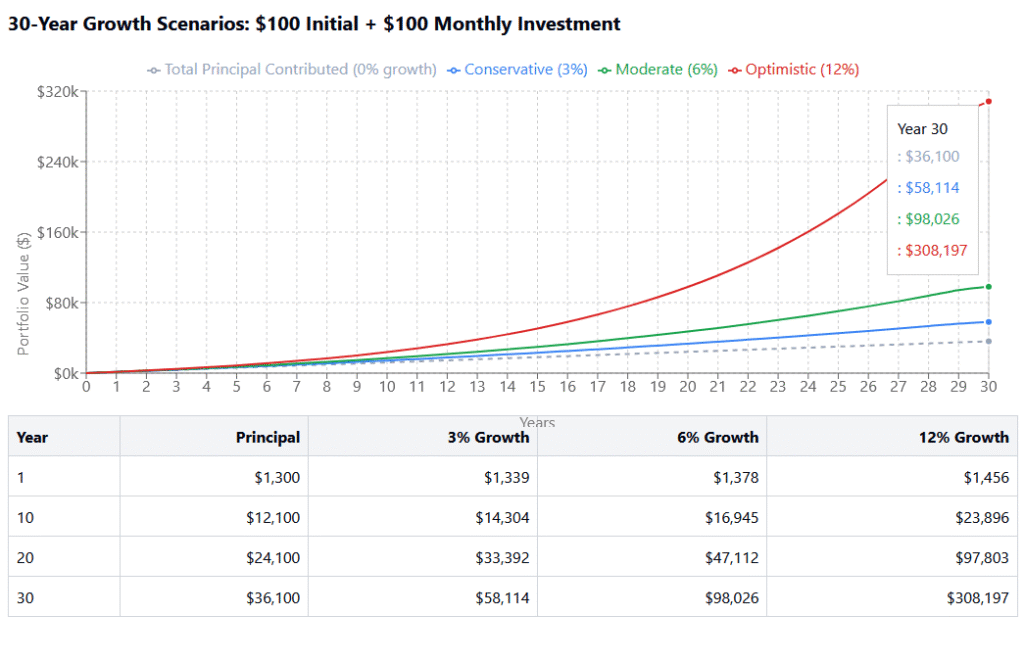

Meet Kai, a 23-year-old app developer in Bristol. Kai’s starting small, investing £5,000 a year in a Stocks and Shares ISA. Assuming a 7% average annual return (a reasonable estimate for a diversified portfolio), Kai’s £5,000 yearly contributions could balloon to over £200,000 in 20 years, thanks to compounding [5]. Markets can dip, so Kai picks a mix of funds to spread the risk.

Top Stocks and Shares ISA Tips

- Invest Regularly: Monthly contributions smooth out market ups and downs via pound-cost averaging.

- Reinvest Dividends: This turbocharges your returns over time.

- Match Risk to Goals: Younger investors can lean into higher-risk equities for bigger potential gains [4].

New to investing? Platforms like Nutmeg or Hargreaves Lansdown offer robo-advisors or ready-made portfolios, so you don’t need to be a stock market guru [5]. Plus, you can transfer existing ISAs to better providers without losing your ISA allowance.

Keep Your Savings Safe with a Cash ISA

For emergency funds or short-term goals, a Cash ISA is your safe bet, offering tax-free interest [6]. This is key if you earn enough to hit the Personal Savings Allowance (£1,000 for basic rate taxpayers, £500 for higher rate) and want every penny of interest.

Imagine Priya, a 30-year-old nurse in Birmingham. She’s saving £10,000 for a career break to travel. By parking her money in a Cash ISA, Priya keeps her interest tax-free and accessible. She splits her funds: £5,000 in an easy-access Cash ISA for emergencies and £5,000 in a 1-year fixed Cash ISA for better rates.

Maximising Your Cash ISA

- Shop for Rates: Check comparison sites like Moneyfacts for top Cash ISA rates [3].

- Choose Access Wisely: Easy-access ISAs for flexibility; fixed-term for higher returns if you can lock funds away.

- Ladder Your Savings: Spread funds across ISAs with different terms (e.g., 1-year, 2-year) for access and returns [6].

Cash ISA Options Table

| Type | Access | Typical Rate (2025) | Best For |

|---|---|---|---|

| Easy-Access ISA | Instant | 3–4% | Emergency funds |

| 1-Year Fixed ISA | After 1 year | 4–5% | Short-term savings |

| 2-Year Fixed ISA | After 2 years | 4.5–5.5% | Longer-term savings |

Conclusion

The £20,000 ISA allowance in 2025 is your chance to level up your personal finance. Whether you’re saving for a home with a Lifetime ISA, growing wealth via a Stocks and Shares ISA, or securing funds in a Cash ISA, there’s a strategy to match your vibe. Start early, mix and match ISAs, and check HMRC for the latest rules [1]. Your future self will thank you! Disclaimer: This isn’t financial advice—chat with a pro advisor before diving in.

References

[1] HM Revenue & Customs, “Individual Savings Accounts (ISAs),” [Online]. Available: https://www.gov.uk/individual-savings-accounts.

[2] HM Revenue & Customs, “Lifetime ISA,” [Online]. Available: https://www.gov.uk/lifetime-isa.

[3] Moneyfactscompare.co.uk, “ISA Allowance 2025/26 Explained | Rules and Limits,” [Online]. Available: https://moneyfactscompare.co.uk/isa/guides/how-the-isa-allowance-works/.

[4] HL.co.uk, “ISA allowance 2025/2026: current ISA limits & rules,” [Online]. Available: https://www.hl.co.uk/investment-services/isa/isa-allowance.

[5] Nutmeg.com, “ISA Allowance Limits & Tax Year End Dates,” [Online]. Available: https://www.nutmeg.com/isas/isa-allowance-limits-tax-year-end-dates.

[6] YBS.co.uk, “What is the ISA allowance for 2025/26?” [Online]. Available: https://www.ybs.co.uk/savings/guides/what-is-the-isa-allowance.