Explore the best teen bank accounts in the USA for 2025, featuring no fees, mobile banking, and financial literacy tools. Perfect for Gen Z teens and millennial parents seeking top banking solutions for financial freedom.

Introduction

In a digital era where financial independence is a must, equipping teenagers with the right bank account is key to mastering money management. A 2015 PISA study revealed that 22% of teens lack basic financial skills [7], highlighting the urgency of early financial education. Teen bank accounts offer a practical way to learn budgeting, saving, and spending, tailored for tech-savvy Gen Z and overseen by millennial parents.

This guide dives into the top teen bank accounts in the USA for 2025, packed with SEO-rich insights on no-fee banking, mobile apps, and parental controls. Whether you’re a teen chasing financial freedom or a parent fostering responsibility, this blog is your go-to resource for engaging, actionable advice. Let’s unlock the best banking options for 2025!

Key Features to Seek in a Teen Bank Account

Selecting the ideal teen bank account requires balancing independence with guidance. Here are essential features to prioritize for Gen Z teens and millennial parents:

- Zero Monthly Fees: No-fee accounts ensure teens keep their savings, making banking stress-free and accessible [1].

- No Minimum Balance: Accounts without balance requirements support teens in managing money without penalties [2].

- Debit Card Access: A debit card empowers teens to make purchases and withdraw cash, building responsible spending habits [3].

- Mobile Banking Apps: User-friendly apps with budgeting tools appeal to Gen Z’s digital lifestyle, enabling expense tracking and goal-setting [1].

- Parental Oversight: Transaction alerts and spending limits offer millennial parents control while fostering teen autonomy [2].

- Financial Education Tools: Banks providing resources on budgeting and saving help teens develop lifelong skills [4].

- Interest-Earning Accounts: Accounts with competitive APYs teach teens the power of saving and compound interest [3].

- Fee-Free ATM Access: Nationwide ATM networks prevent extra charges, ideal for active teens [1].

These features make teen accounts a win-win, blending Gen Z’s need for freedom with millennial parents’ focus on guidance.

Top Teen Bank Accounts for 2025

We’ve curated the best teen bank accounts for 2025, based on expert reviews and user feedback. Below is a comparison table, followed by in-depth reviews of three standout options optimized for SEO and engagement.

Comparison Table: Best Teen Bank Accounts 2025

| Bank Account | Age Range | Monthly Fee | APY | Minimum Deposit | Key Features |

| Capital One MONEY Teen Checking | 8-17 | $0 | 0.10% | $0 | No fees, mobile app, parental controls, Zelle, 70,000+ free ATMs |

| Chase High School Checking℠ | 13-17 | $0 | None | $0 | No fees, debit card, budgeting tools, $100 bonus, parental oversight |

| Alliant Teen Checking | 13-17 | $0 | 0.25%* | $0 | No fees, earns interest, ATM fee refunds, parental monitoring |

| Axos Bank First Checking | 13-17 | $0 | 0.10% | $50 | No fees, earns interest, ATM fee reimbursement |

| Connexus Credit Union Teen Checking | 10-17 | $0 | Up to 2.00%** | $0 | High APY, no fees, 67,000+ free ATMs |

In-Depth Reviews

- Capital One MONEY Teen Checking

Capital One’s MONEY Teen Checking is a top pick for teens aged 8-17, blending no-fee banking with digital tools that resonate with Gen Z. Millennial parents love its robust oversight features.

- No Fees: Zero monthly, overdraft, or out-of-network ATM fees make banking cost-free [5].

- Interest Earning: Offers a 0.10% APY on all balances, encouraging teens to save [5].

- Parental Controls: Parents can set limits and monitor transactions via the Capital One app, ensuring safety [1].

- Mobile Banking: A sleek app with budgeting tools and spending trackers appeals to digital natives [5].

- ATM Network: Access to 70,000+ fee-free ATMs supports teens’ active lifestyles [5].

- Zelle Integration: Easy money transfers enhance convenience for peer payments [5].

This account empowers teens to manage money while giving parents peace of mind

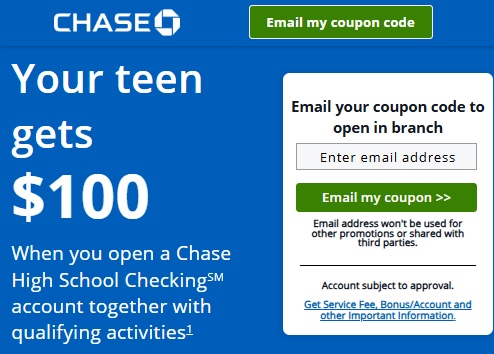

- Chase High School Checking℠

Chase’s High School Checking account, designed for teens aged 13-17, offers a joint account with strong parental controls, ideal for millennial families and Gen Z users.

- No Fees: No monthly fees or minimum deposit requirements ensure accessibility [6].

- Debit Card: Provides a debit card for purchases and ATM withdrawals, teaching spending discipline [6].

- Budgeting Tools: Chase’s mobile app includes expense tracking and budgeting, engaging tech-savvy teens [3].

- Parental Monitoring: Parents receive transaction alerts and can set limits, aligning with millennial priorities [6].

- Sign-Up Bonus: A $100 bonus for qualifying activities within 60 days motivates teens [6].

Converting to a Chase Total Checking account at age 19, this account supports long-term banking needs.

- Alliant Credit Union Teen Checking

Alliant’s Teen Checking account, for ages 13-17, combines credit union benefits with competitive features, appealing to families seeking value and community.

- No Fees: No monthly or minimum balance fees keep banking affordable [4].

- High APY: Earns 0.25% APY with e-Statements and monthly deposits, rewarding savers [4].

- ATM Access: Over 80,000 fee-free ATMs and up to $20 monthly ATM fee rebates suit mobile teens [4].

- Parental Controls: Monitoring and limit-setting tools ensure responsible use [4].

- Digital Banking: Intuitive online and mobile platforms cater to Gen Z’s digital habits [4].

Alliant’s customer-focused approach makes it a standout for families

Tips for Mastering Teen Bank Accounts

To maximize a teen bank account’s benefits, follow these SEO-optimized tips to build financial literacy:

- Set Clear Goals: Encourage teens to save for short-term (e.g., gaming gear) and long-term (e.g., college) goals using app-based trackers [2].

- Monitor Spending: Use mobile apps to review expenses, helping teens curb impulse purchases [3].

- Avoid Fees: Teach teens to use in-network ATMs to prevent charges, even with no-fee accounts [1].

- Understand Interest: Explain APYs and compound interest to motivate saving [4].

- Practice Cybersecurity: Guide teens on strong passwords and phishing awareness for safe banking [2].

- Foster Parent-Teen Dialogue: Regular money talks blend guidance with independence, appealing to both generations [7].

These strategies empower Gen Z teens to take charge while aligning with millennial parents’ mentorship goals.

Conclusion

The best teen bank accounts in the USA for 2025, like Capital One MONEY Teen Checking, Chase High School Checking℠, and Alliant Teen Checking, offer no fees, mobile banking, and parental controls, perfectly suited for Gen Z teens and millennial parents. By choosing an account that matches your family’s needs, you set the stage for financial success.

Take action now: explore options at Capital One or Chase, discuss goals with your teen, and open an account to kickstart their financial journey. With the right tools, 2025 is the year for teens to master money management!

References

[1] Business Insider, “Best Teen Checking Accounts of 2025,” Apr. 29, 2025. [Online]. Available: https://www.businessinsider.com/personal-finance/banking/best-teen-checking-accounts

[2] Forbes Advisor, “Best Teen Checking Accounts Of 2025,” May 1, 2025. [Online]. Available: https://www.forbes.com/advisor/banking/checking/best-teen-checking-accounts/

[3] The College Investor, “Best Banks For Teenagers In 2025,” Apr. 7, 2025. [Online]. Available: https://thecollegeinvestor.com/39449/best-teen-checking-accounts/

[4] Forbes Advisor, “Best Savings Accounts For Kids And Teens in 2025,” May 3, 2025. [Online]. Available: https://www.forbes.com/advisor/banking/savings/best-savings-accounts-for-kids/

[5] Capital One, “MONEY: Teen Checking Account with Debit Card,” accessed May 17, 2025. [Online]. Available: https://www.capitalone.com/bank/checking-accounts/teen-checking-account/

[6] Chase, “Chase High School Checking,” accessed May 17, 2025. [Online]. Available: https://www.chase.com/personal/checking/student-checking

[7] ChooseFi Foundation, “Scary Financial Literacy Statistics for Kids, Teens & Adults (2021),” Oct. 27, 2021. [Online]. Available: https://www.choosefifoundation.org/blog/scary%2520financial%2520literacy%2520statistis