Unlock financial freedom with this ultimate budgeting guide for millennials and Gen Z in the USA. Discover expert tips, budgeting apps, and the 50/30/20 rule to manage money, crush debt, and save smarter. Start your journey to financial success today!

Introduction

Millennials and Gen Z, listen up! Navigating finances in the USA is no joke—skyrocketing student loans, soaring rent, and the constant pull of trendy lifestyles can make your wallet cry. But here’s the real talk: budgeting is your secret weapon to slay your finances, achieve financial freedom, and still live your best life. Whether you’re saving for a dream vacation, tackling debt, or building an emergency fund, this ultimate budgeting guide is packed with high-quality tips to help you manage money like a pro. Let’s dive into the no-cap strategies that resonate with both millennials (born 1981–1996) and Gen Z (born 1997–2012) to secure your financial future.

Why Budgeting is a Game-Changer for Millennials and Gen Z

Financial challenges hit hard for young adults in the USA. Gen Z carries an average student loan debt of $22,950, while millennials juggle a hefty $42,600 [1]. Combine that with rising costs—rent, groceries, and subscriptions—and it’s easy to feel trapped. In 2023, millennial households had a disposable income of about $97,866 [2], yet many live paycheck to paycheck, driven by FOMO-fueled spending on experiences or tech [3].

Budgeting flips the script by giving you:

- Control: Track every dollar to avoid overspending.

- Stress Relief: Say goodbye to bill-related anxiety.

- Goal Achievement: Save for travel, a home, or early retirement.

- Financial Independence: Build wealth and break the paycheck cycle.

How to Create a Winning Budget

Ready to master your money? Here’s a step-by-step guide to build a budget that works for your vibe:

1. Know Your Income and Expenses

Start by calculating your monthly take-home pay after taxes. If you’re freelancing or hustling on the side, average your income for accuracy. Next, track your expenses using bank statements or apps. Categorize them into:

- Needs: Rent, utilities, groceries, insurance.

- Wants: Dining out, streaming services, shopping.

- Savings/Debt: Emergency fund, student loans, retirement.

2. Adopt the 50/30/20 Rule

The 50/30/20 rule, popularized by Senator Elizabeth Warren, is a fan-favorite for its simplicity. Allocate 50% of your income to needs, 30% to wants, and 20% to savings or debt repayment [4]. For a $3,000 monthly income:

- Needs: $1,500 (rent, bills, groceries)

- Wants: $900 (coffee runs, concerts, new tech)

- Savings/Debt: $600 (emergency fund, loans)

If high rent pushes your needs above 50%, tweak the ratios—try 60/20/20—to fit your life.

3. Set Smart Financial Goals

Goals keep you locked in. Want to pay off $5,000 in loans? Save for a cross-country road trip? Build a $1,000 emergency fund? Set short-term (3–6 months) and long-term (1–5 years) goals to stay motivated. Be specific—saving “$500 in 3 months” is better than “saving more.”

Here’s a sample budget for a $3,000 monthly income:

| Category | Percentage | Amount |

| Needs | 50% | $1,500 |

| Wants | 30% | $900 |

| Savings/Debt | 20% | $600 |

Alternative Budgeting Methods

The 50/30/20 rule isn’t one-size-fits-all. Explore these options [5]:

- Zero-Based Budgeting: Assign every dollar a purpose, so income minus expenses equals zero. Ideal for meticulous planners.

- Envelope System: Use cash in labeled envelopes for each category to curb overspending.

- Pay Yourself First: Prioritize savings by setting aside a chunk of income before paying bills.

Pro Tips to Stick to Your Budget

Creating a budget is step one; sticking to it is the real challenge. Here’s how to stay on track without losing your spark:

Leverage Budgeting Apps

Millennials and Gen Z thrive on tech, so use budgeting apps to simplify money management. Top picks include:

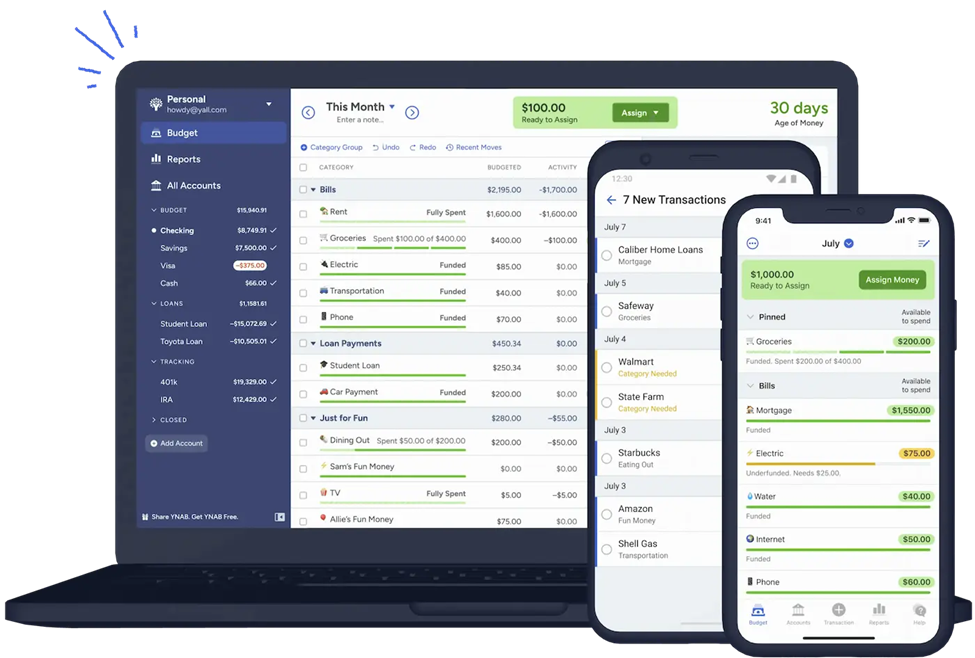

- Mint: Auto-tracks and categorizes spending with savings insights.

- YNAB (You Need a Budget): Helps every dollar find a purpose, dodging debt.

- PocketGuard: Shows your “safe-to-spend” amount after bills and savings.

These apps sync with your accounts for real-time updates, making budgeting effortless [6].

Crush Impulse Spending

Spotted a must-have item online? Hit pause and wait 24 hours before buying. This cools off impulsive urges. Bonus tip: Curate your social media feed to avoid influencers pushing unnecessary purchases [3].

Embrace Loud Budgeting

Gen Z’s “loud budgeting” trend is fire—share your financial goals on TikTok or Instagram to stay accountable. Telling friends you’re saving for a big goal can inspire them to join you in skipping overpriced outings [7].

Tackle FOMO

Social media can trick you into thinking everyone’s balling while you’re budgeting. Reality check: those posts hide debt and stress. Focus on your goals to avoid lifestyle inflation [3].

Review and Adjust

Set a monthly “budget date” to review your spending. Overspent on takeout? Redirect funds next month. Regular tweaks keep your budget aligned with your evolving needs.

Conclusion

Budgeting isn’t about cutting out fun—it’s about making your money work smarter so you can live bigger. For millennials and Gen Z in the USA, mastering money management means crushing student loans, building savings, and chasing dreams without financial stress. Use the 50/30/20 rule, lean on budgeting apps, and embrace trends like loud budgeting to stay on track. Start small, stay consistent, and watch your financial game level up. Your future self is already cheering!

References

[1] Education Data Initiative, “Student Loan Debt by Generation (2024): Millennials, Gen Z, etc.,” 2024. [Online]. Available: https://educationdata.org/student-loan-debt-by-generation

[2] Statista, “Mean disposable household income by generation U.S. 2023,” 2023. [Online]. Available: https://www.statista.com/statistics/825883/us-mean-disposable-household-income-by-generation/

[3] The Manifest, “Budgeting Money Tips for Millennials,” 2023. [Online]. Available: https://themanifest.com/accounting/budgeting-money-tips-for-millennials

[4] Investopedia, “The 50/30/20 Budget Rule Explained With Examples,” 2023. [Online]. Available: https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp

[5] Mom Does Reviews, “Budgeting for Millennials and Gen Z: A Comprehensive Guide,” Oct. 2023. [Online]. Available: https://www.momdoesreviews.com/2023/10/16/budgeting-for-millennials-and-gen-z-a-comprehensive-guide/

[6] CNBC, “Top money goals for Gen Z and millennials in 2024,” Jan. 2024. [Online]. Available: https://www.cnbc.com/2024/01/01/top-money-goals-for-gen-z-and-millennials-in-2024.html

[7] Business Insider, “How some Gen Zers and millennials are using ‘loud budgeting’ to save money and make frugality cool,” 2024. [Online]. Available: https://www.businessinsider.com/loud-budgeting-tiktok-genz-millennial-save-money-lifestyle-creep-spending-2024-1